Summary

Event Name: Case Krackdown

Objective:

To engage Finance Club members in analyzing significant Indian financial scams.

To cover how the scams occurred, their impact, regulatory actions, and lessons learned.

To enhance understanding of financial frauds, corporate governance, and regulatory measures.

Outcome:

Deepened participants' understanding of financial scams and their economic impact.

Highlighted key lessons in corporate governance, ethical finance, and regulatory measures.

Fostered critical thinking, teamwork, and research skills among participants.

Successfully engaged members through interactive presentations and discussions on real-world financial frauds.

Brief Report: The event took place over two days, on the 23rd August 2024 (two sessions) and 24th of August 2024 (one session), with nine teams presenting on various infamous scams.

Snehlata Kumari, Head of The Finance Club welcomed Dr. Disha Pathak, mentor of the Finance club, the audience and presenters at the beginning of the activity, setting the tone for an informative and engaging session.

(Snehlata Kumari, Head of The Finance Club welcoming Dr. Disha Pathak (Mentor) and the participants)

Day - 1:

- Team 1: (Shreyas, Dhruv, Akshay, and Shikhar) presented the Vijay Mallya Loan Default Case (2016), explaining how Mallya's lavish lifestyle and mismanagement of Kingfisher Airlines led to massive unpaid loans. They discussed the legal fallout, its impact on banks, and the need for stricter credit assessment

- Team 2: (Jigyasa, Sumedha, Samarth, and Snehlata) delved into the ICICI Bank and Videocon Loan Scandal, focusing on the mismanagement within ICICI, the involvement of Chanda Kochhar, and how the scandal exposed gaps in corporate governance and oversight.

- Team 3: (Amulya, Shailaja, Shreya, and Samhita) discussed the Yes Bank Scam (2010), highlighting the mismanagement under Rana Kapoor, the financial troubles that followed, and how the crisis prompted tighter banking regulations.

- Team 4: (Sainath, Sanjana, Disha, and Sougandh) analyzed the Satyam Scam (2009), detailing how Ramalinga Raju falsified accounts to show inflated profits, leading to one of India’s biggest corporate frauds and subsequent reforms in accounting practices and corporate transparency.

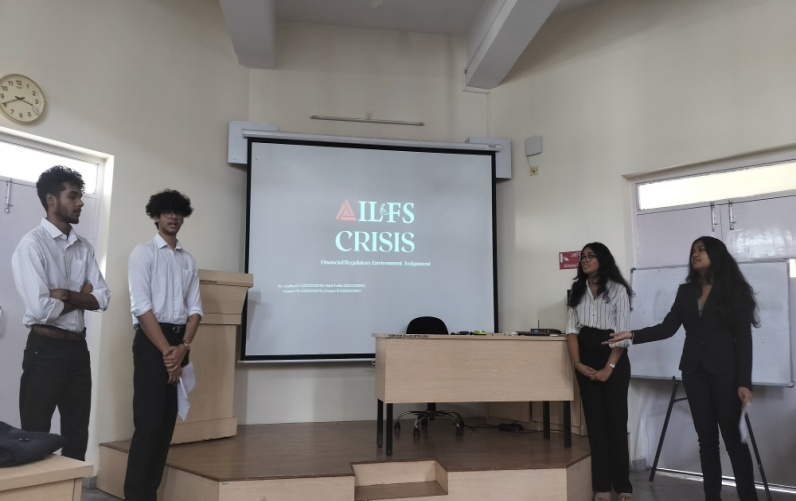

- Team 5: (Sri Pranav, M Pranav, Aadhya, and Sejal) presented on the IL&FS Crisis (2018), explaining how poor management and reckless lending practices caused the infrastructure finance company to default, sparking a financial crisis that led to significant reforms in financial oversight.

- Team 6: (Kyra, Shehbaz, Rohan, and Goutham) closed the first day by presenting on the Ketan Parekh Scam (2001), detailing how Parekh’s stock market manipulation caused a market crash and led to reforms in stock trading regulations and more stringent oversight of market operations.

Day - 2:

- Team 7: (Nida, Vinit, and Ayushman) kicked off the second day by covering the DHFL Scam (2019), explaining how the company diverted funds and committed large-scale loan fraud, which led to its collapse and highlighted the need for tighter regulation of NBFCs.

- Team 8: (Abraham, Naman, and Dhruvil) presented on the Sahara India Parivar Scam (2012), describing how Subrata Roy raised funds from small investors through illegal bond issues and the long legal battle that followed, showcasing the role of SEBI in bringing justice.

- Team 9: (Archita, M Pranesh, Shubhangini, and Ruchirekha) concluded the activity with the Harshad Mehta Scam (1992), one of the most infamous stock market scams in Indian history. They explained how Mehta manipulated stock prices through banking loopholes, leading to a massive market crash, and how this scandal changed stock market regulations permanently.

Dr. Disha Pathak provided invaluable guidance throughout the entire session. After each presentation, she engaged with the teams by asking insightful questions, which not only tested their understanding but also deepened our collective learning. She discussed the key highlights of each case, ensuring that the critical aspects were thoroughly explored. Following every presentation, a Q&A session was held, allowing the audience to clarify doubts and further discuss the intricacies of each scam, making the activity highly interactive and informative.

GALLERY

(Participants presenting on their allotted case studies and their scams)

(Audience asking their doubts)